The Premium Agency Banking Solution

The Benefits of Agency Banking

↓25%

cost of transaction

Using agents can reduce the cost of doing a transaction by about 25 percent compared to branch transactions. (IFC)x15

points of sale

An MFI multiplied its points of sale 15 times with the introduction of Agency Banking from Software Group.

↑300%

transactions

A client achieved a 300% increase in transactions and a 600% increase in transaction value within 3 years with Agency Banking.

x7

more savings

An institution increased the amount of savings mobilized through the agent channel seven-fold within a year.

Branchless Banking Expansion

Scale your points of service without investing in costly branch and ATM networks

Cut Operational Costs

Reduce heavy ATM and branch network costs and decongest branches. Serve high-volume, low-value transactions via agents.

Offer Convenience

Provide cash withdrawals, deposits, top-up, bill payments, and more, close to where your customers live, at extended hours.

Profit from New Channels

Mobilize deposits to decrease cost of funds. Activate new revenue streams by expanding agents' portfolio beyond cash in/out.

Accelerate Financial Inclusion

Reach unbanked and underserved customers before competitors through local agents and merchants they can trust.

Baobab Increased Points of Sale 15 Times with Agency Banking

Baobab, a leading financial institution focusing on financial inclusion in Africa and China, increased the proximity of their financial services through a robust agent network. End customers enjoy a new banking experience with significantly quicker on-boarding. Baobab multiplied its points of sale 15 times with the introduction of alternative delivery channel solutions from Software Group.

6835.png)

Forrester Consulting Total Economic Impact™ Study:

369% Three Year ROI from Agency Banking

An independent commissioned study by Forrester Consulting demonstrates the significant cost savings and business benefits enabled by Software Group’s Agency Banking Solution.

Agent Banking Best Practices Delivered

Leverage on our experience from deploying Agency in more than 15 countries.

Everything You Need to Grow and Manage a Successful Agent Network

Convert local shops into agents. Manage from a central space.

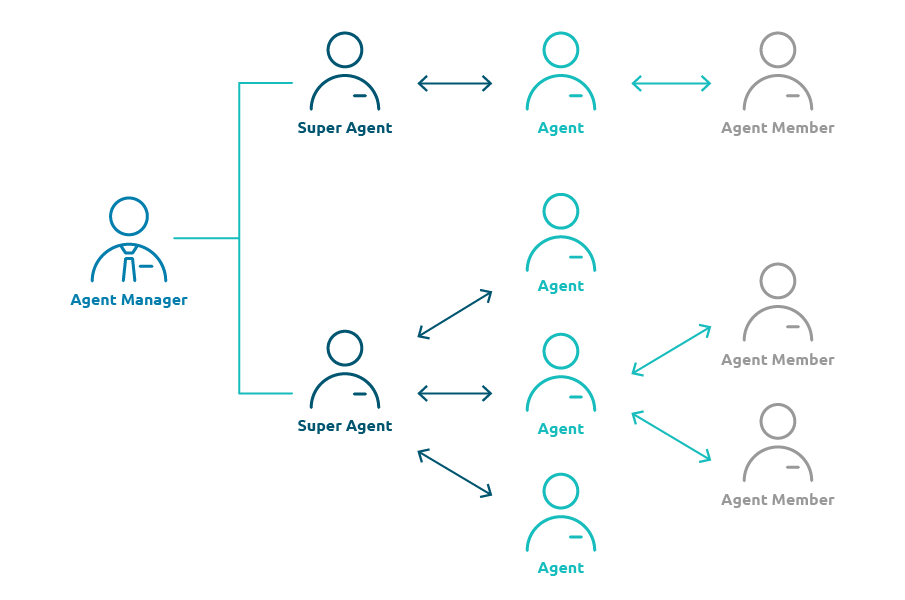

- Organise with unlimited agent hierarchy and support for agent types, roles, and access levels.

- Scale the network fast by onboarding new agents on the go with secure authentication and geolocation.

- Set up flexible rules for commission sharing, fees and limits. Manage float and liquidity.

- Minimize agent training through intuitive self-service apps with superb UX on smartphones, USSD, POS.

Enable Agents to Transact. Watch Your Customer Base & Profits Grow.

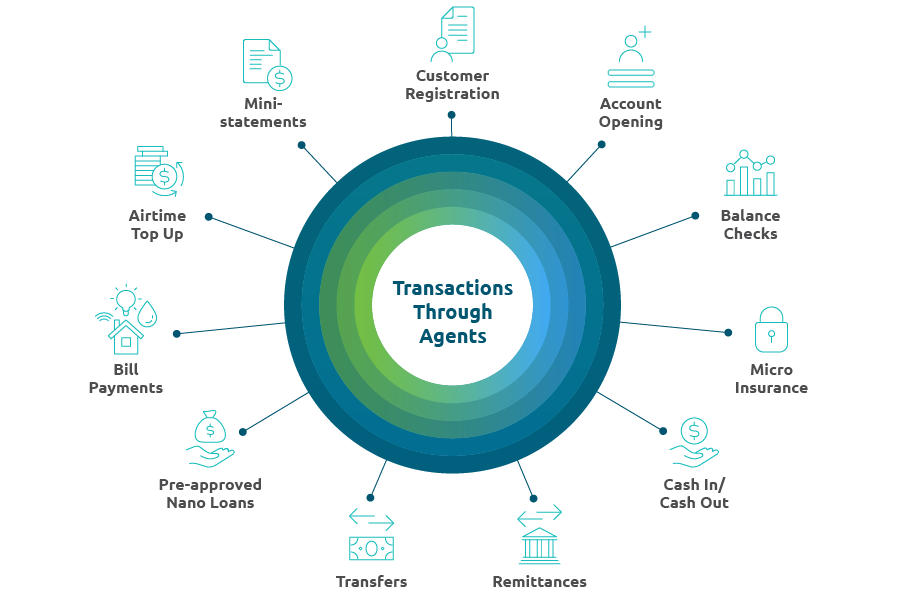

Provide a multitude of transactions through agents.

- Customer registration & account opening with secure data capture and Bio, Card or OTP eKYC authentication

- Real-time transactions - cash in/ cash out, transfers, balance checks, mini statements

- Value-add transactions for new revenue streams - airtime top up, bill payments, pre-approved nano loans, remittances, micro insurance, etc.

Flexible Approaches Based on Your Needs

Full-scale, Tailored Agency Banking

License/ Subscription Model

If your business model demands a fully customizable Agency Banking Solution with an entire suite of features and flexible deployment options, all tailored to your needs.

Agency Banking 'Fast Track'

Pay-per-use/ Revenue-share

If you want to start fast with an affordable, out-of-the-box cloud solution with standard features without investing in IT infrastructure. Let us manage the platform.

Celent Recognizes Software Group's Agency Banking Expertise

According to Celent, many can learn from Software Group’s experience helping financial institutions foster financial inclusion for the last 10 years. In this brief, Celent’s analysts explore our Agency Banking Solution, acknowledging it as a viable option for financial institutions looking for technology partners.

A Digital Transformation Platform in Action.

Agency Banking is built on DigiWave Platform. Future-proof your digital channel business case.

Centralized Management. Multi-country. Multi-tenant

Manage all your digital channels from a central administration portal. Leverage on mature agency banking capabilities.

Seamless API-driven Integrations

Easily integrates with your core banking and legacy systems. Embed third-party provider services to enrich your offering.

Configurable Workflows

Customize your own or use out-of-the-box workflows. Benefit from multi-level loan decisions, fueled by data. Digitize, automate and streamline all processes.

Credit Scoring & Advanced Analytics

Offer fast track loans to your best customers and nurture the rest. Lower delinquency risk from the start. Identify opportunities through analytics.

Flexible Onboarding & Origination Forms

Easily configure your own forms. Store data on the DigiWave platform or directly in your core banking or other systems.

24/7 Service Availability

Excellent reliability in both mature and developing markets. Seamless payment processing with transaction authorization, reconciliation and 24/7 store and forward.

The Agency Banking Solution

at a Glance

1.6 billion people around the world do not have access to basic financial services. In order to scale sustainably, financial service providers need to look beyond costly brick-and-mortar to expand their reach through innovative digital channels.

-

Blog

6 Ideas How to Transform Agency Banking into a Low-Touch Channel

In light of the current Covid-19 crisis, causing the emergence of completely new customer behaviors, how can financial institutions get Agency ready for low-touch?

-

Webinar

Webinar: How to Win with Agency Banking?

Join this webinar to learn how to start with Agency Banking, what best practices to follow, and how to avoid the common pitfalls.

-

Webinar

Webinar: Real-life Agency Banking Success Stories

Hear Software Group's customers’ first-hand experience implementing Agency Banking solutions in their financial institution.

Why Choose Software Group?

Clients Scaling Their Market with Agency Banking Software