Powerful Credit Risk Management System

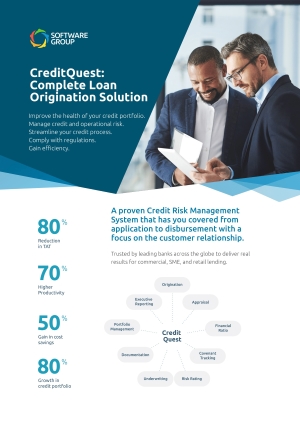

A single loan origination solution that brings real results for bank teams. Trusted by leading organizations across the globe, CreditQuest provides commercial and retail loan origination, risk ratings, advanced analysis, underwriting, documentation, executive reporting, and portfolio management with a focus on the customer relationship.

80%

Reduction in TAT

Reduced turnaround time to originate and process a loan

70%

Higher productivity

With standardized workflow, accurate data, collaboration, and 360° degree view

80%

Growth in credit portfolio

Real result measured at a CreditQuest client.

50%

Gain in cost savings

Increased operational efficiency and improved profitability

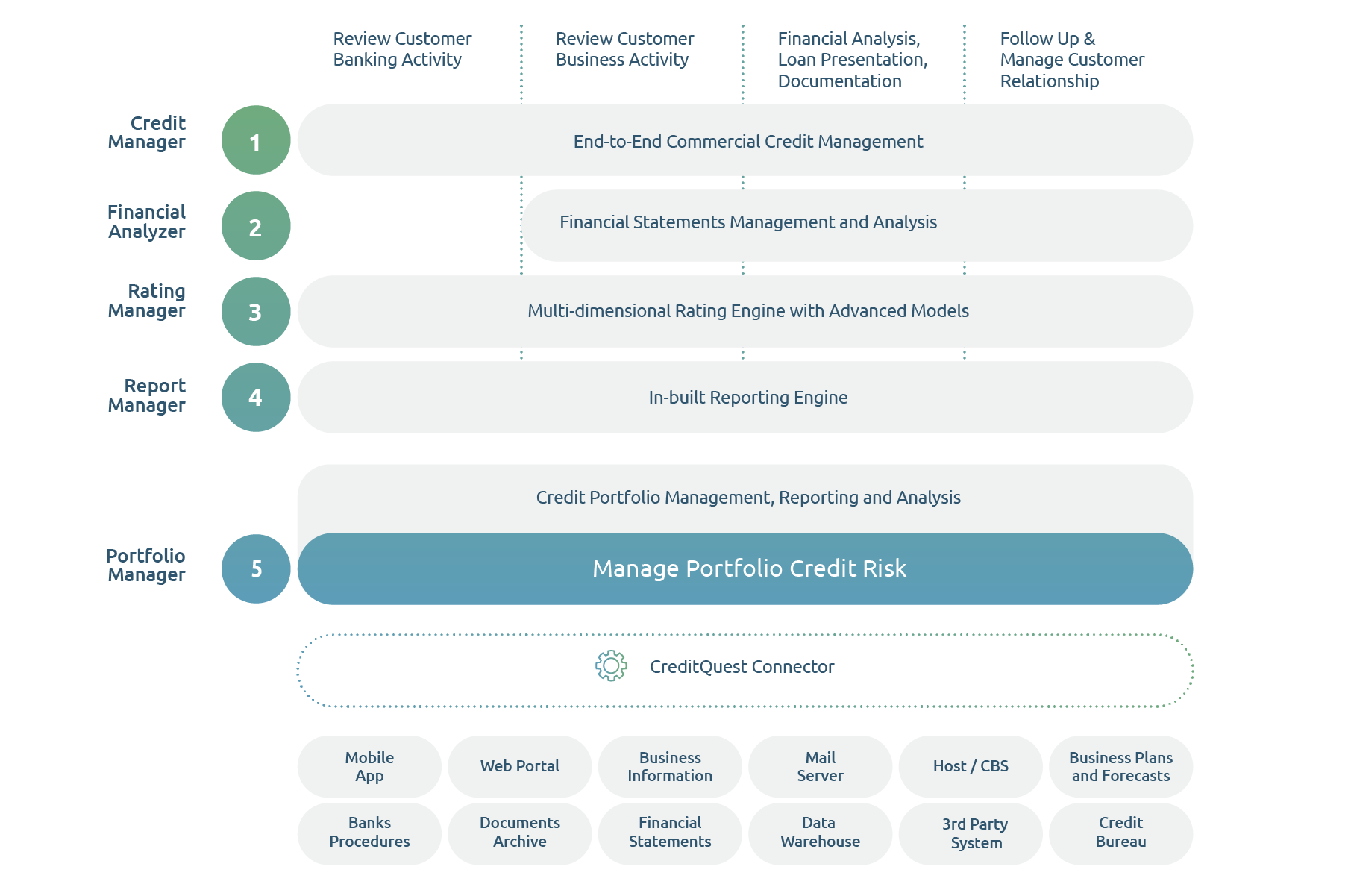

Key Solution Modules at a Glance

Fully-featured, out-of-the-box, configurable to commercial, retail, SME lending

Supercharge the Full Credit Risk Management Lifecycle

Digital Compass for Lenders

Are your credit operations future-proof? Test your digital maturity to see how your level of automation compares to competitors. Discover new growth opportunities with real-time tips to improve your lending business.

-

Blog

Banks Can Leverage Technology to Rebuild a Healthy Credit Portfolio

The defining issue in the success of a bank is the quality of its loans. Covid-19 has torn through institutional loan books, driving up the proportion of loans where repayments are suspended and banks are earning far less from their existing lending.

-

Blog

7 Lessons For Choosing The Best Loan Origination System

Key LOS features that help credit teams make faster and better credit decisions while delivering an outstanding borrowing experience.

-

News

Allianz Bank Digitalizes Business Lending Processes in Partnership with Software Group

Allianz Bank Bulgaria in partnership with Software Group has launched a project for implementation of a complete software solution for loan application and credit risk management - CreditQuest.

Improve Portfolio Growth, Credit Quality & TAT

Optimize and digitize the whole credit process and exceed targets

Streamline Credit Operations

Automate routine tasks and reduce paperwork with a streamlined workflow. Use out-of-the-box capabilities - risk rating models, collateral management, automated credit memos, compliance with covenants, and more.

Control & Manage Risk

Control credit risk at the point of origination, upon individual account review, and at the portfolio level. Enforce the Bank's credit policy and empower teams to make data-driven decisions that mitigate risk.

Grow Portfolio & Revenue per Customer

Achieve double-digit growth in cumulative customer lifetime value. Improve customer service with a unified view of customer financial data and documents.

Leverage a Single Platform

A single platform for all your business lines: SME, commercial, corporate, retail loans. Easily integrated with core banking systems.

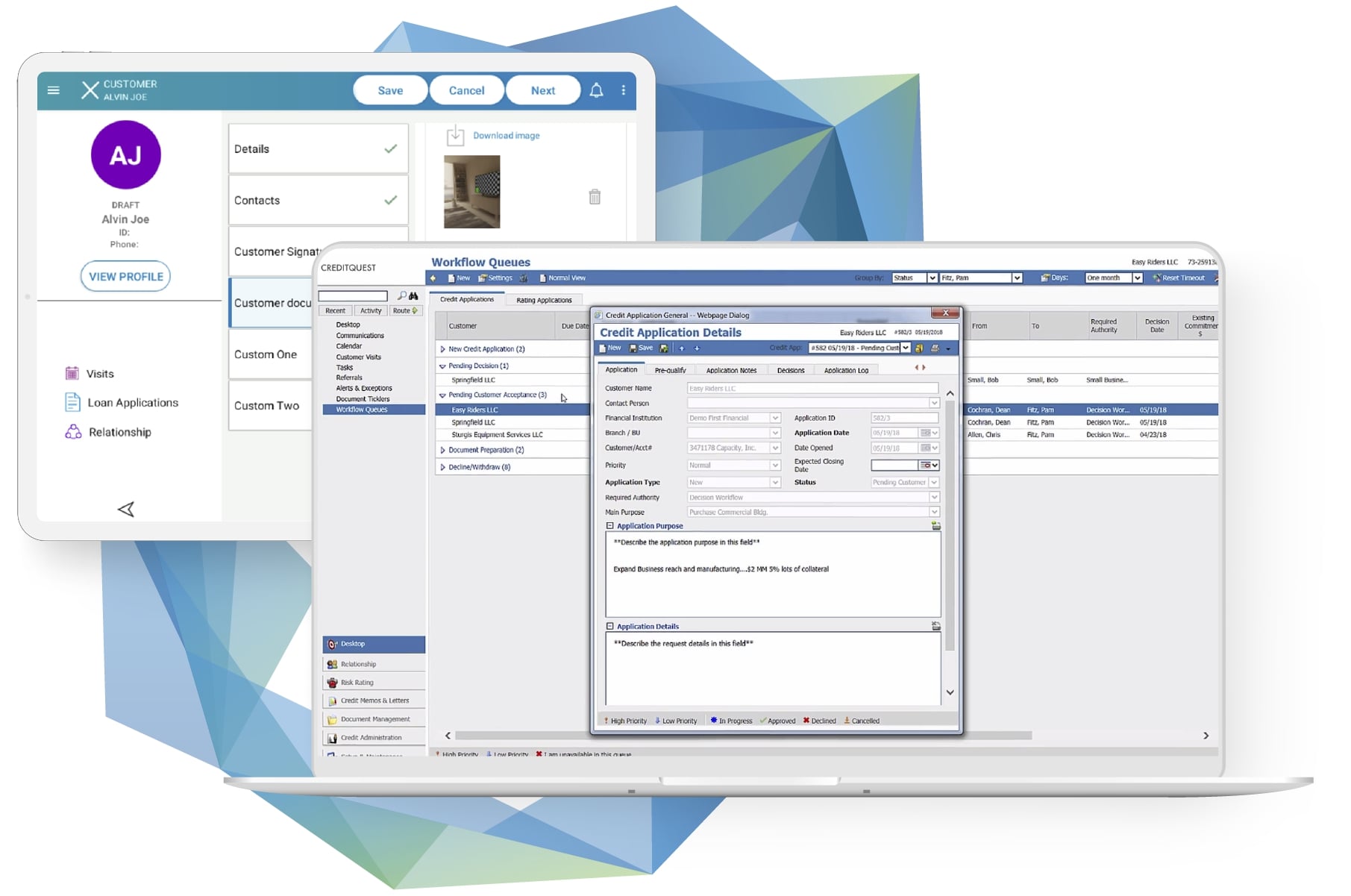

CreditQuest Solution Overview

The complete loan origination solution by Software Group enables relationship managers, credit analysts, credit committees and senior executives make profitable credit decisions faster, achieving double-digit growth through a single platform.

Master Loan Origination Challenges with Real Results

Credit Risk Management

Enforce Credit Policy

Mitigate credit & operational risk

Optimize manual, paper processes & reducing operational costs

Business Growth

Reduce time to approval

Improve customer experience & retention

Win market share and compete with alternative lending providers

Portfolio Management

Improve portfolio management reporting

Enhance data quality and insights

Optimize the portfolio, avoid over-exposure

Clients Growing Their Lending Business with CreditQuest

Ready to take your lending strategy to the next level?