Addressing MFIs' Key Challenges

Software Group supports digitalization in 7 out of the 10 biggest MFI networks around the globe.

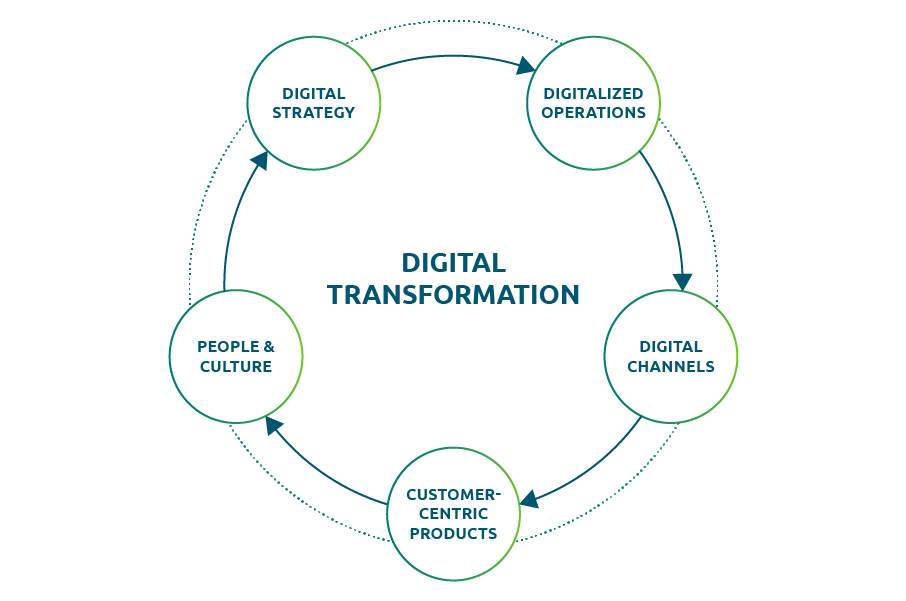

Helping MFIs Go through Digital Transformation

Accelerating Financial Inclusion

Increase Outreach through Digital Channels

Digitalize traditional distribution channels, such as branches, field services and agency banking. Expand into remote, underserved markets at a minimal cost.

Digitize Operations to Achieve Efficiency

Reduce paper-based processes. Improve data quality and speed through real-time integrations (credit bureaus, scoring, identity, etc.) and flexible end-to-end workflows between the front and back office.

Deliver Customer-Centric Products

Acquire customers anywhere with remote customer onboarding and loan origination for both individual and group lending products and processes. Personalize offerings based on data to improve portfolio quality.

Balance Technology and Human Touch

Leverage your biggest asset - customer relationships, and enhance it with digital efficiency. Find the right balance between tech and touch to acquire and retain customers who are not digitally-ready.

Whitepaper: Field Staff Digitalization in Microfinance

Digital transformation is high on Microfinance Institutions' agenda, but the path to its successful implementation may hold different strategic directions. Software Group's whitepaper lays out our business, technological and implementation lessons learned while helping MFIs digitalize their field operations.

Digitalization Solutions for Microfinance

Leverage Software Group's platform and digital channel solutions for an end-to-end approach to financial service distribution

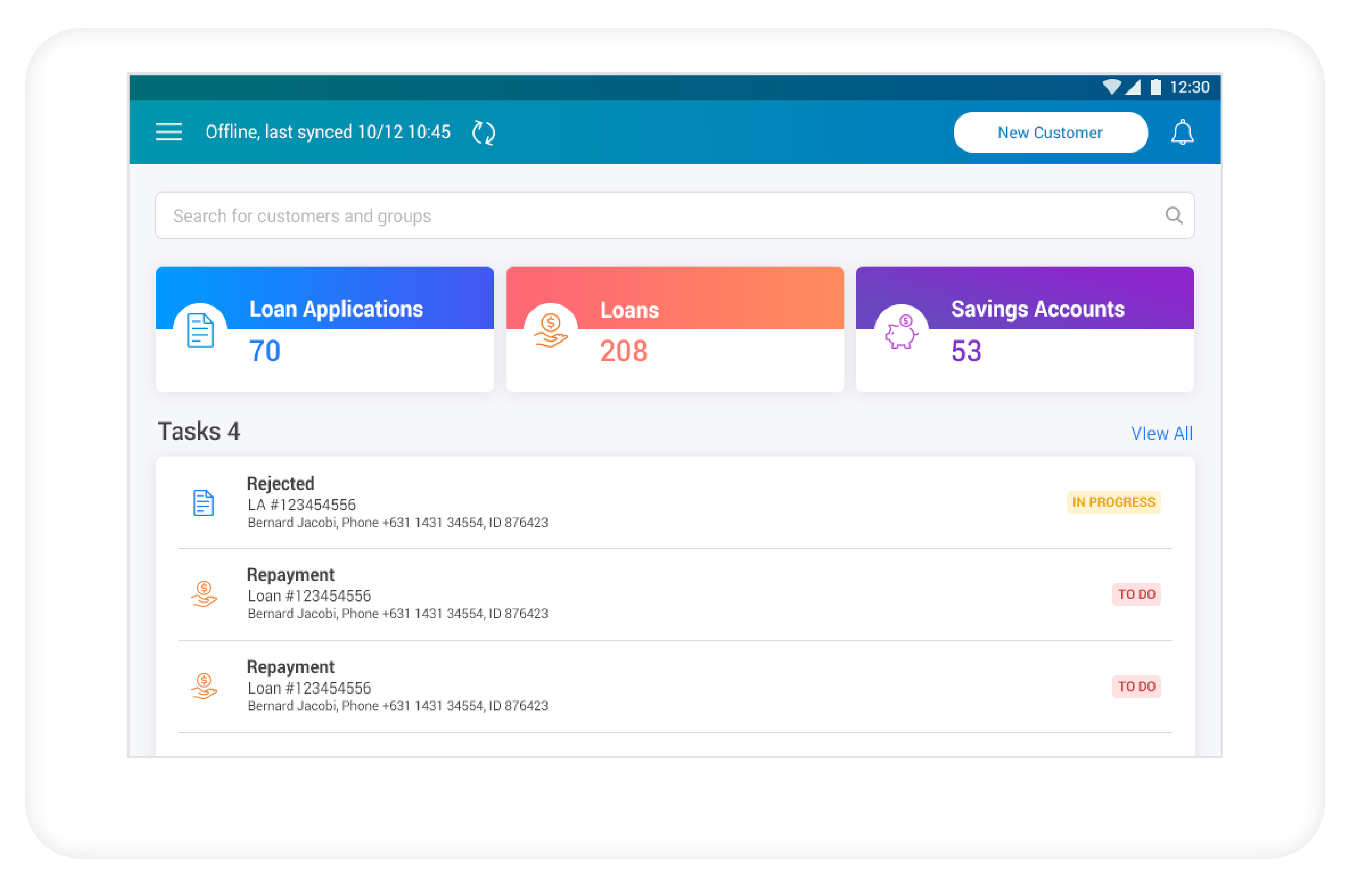

Digital Field Application

A leading solution for Remote Customer Onboarding, Account Opening, Loan Origination, Group Lending, Savings and More

Dramatically improves field officer productivity, portfolio quality & operational efficiency. Reduces paper and decreases field service costs.

Agency Banking Solution

Accelerate financial inclusion in remote, underserved markets through a cost-efficient network of 3rd-party agents, serving customers on your behalf.

Mobilize more deposits through agents, offer value-added services, such as prequalified nano loans. Leverage everything you need to grow and manage a successful agent network - advanced agent analytics, hierarchies, etc.

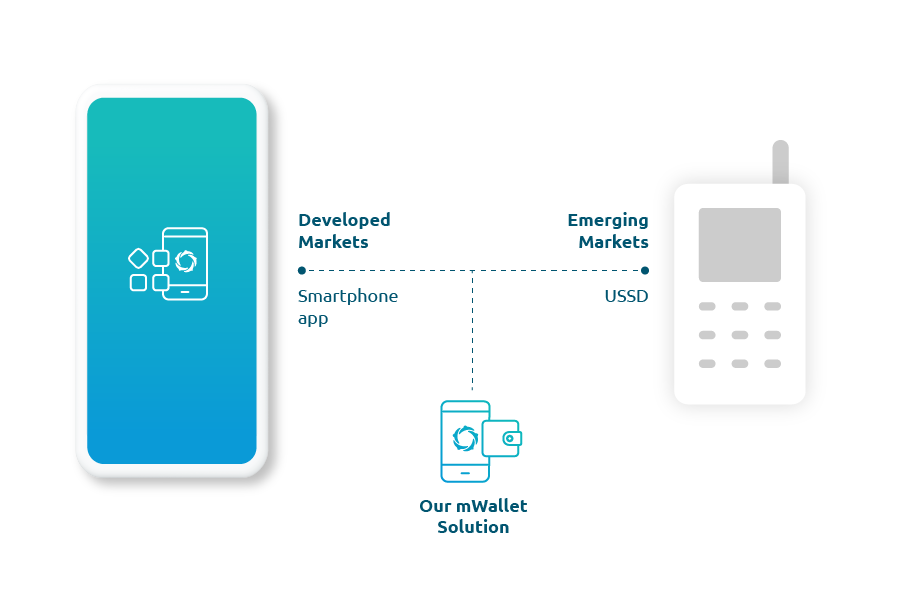

Mobile Wallet Solution

Extend financial services to the bottom of the pyramid at a low cost (for both USSD and smart devices).

Software Group's Mobile Wallet Solution helps microfinance institutions utilize the opportunity of a digital self-service channel, retaining and growing their customer base. An extremely flexible platform which can serve various digital wallet business cases.

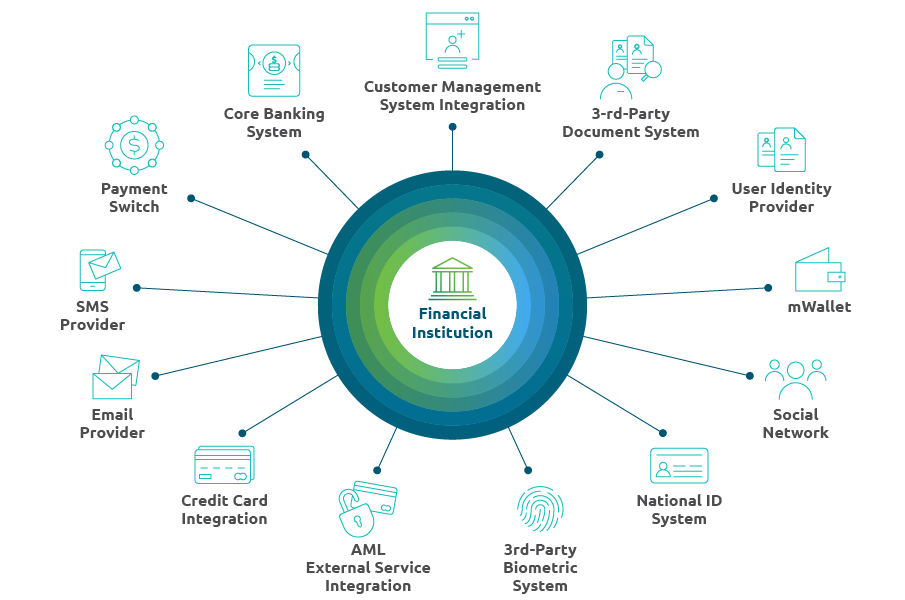

Enterprise Integration Platform

Build and orchestrate a connected digital business, ready to move fast.

EIP modernizes legacy infrastructure via APIs, advanced integration patterns and reusable microservices. Helps you easily connect to credit bureaus, 3rd parties, national registries, telcos, etc

Microfinance Solutions Powered by a Digital Banking Platform

Take a future-proof approach to digital transformation, based on a platform. Modernize legacy systems, processes, products, channels and customer engagement with DigiWave Enterprise Digital Banking Platform.

Why MFIs Partner with Software Group?

-

Blog

Digitalizing Field Operations – Challenges and Opportunities for Financial Service Providers

Geraldine O’Keeffe, Software Group's Chief Innovation Officer, shares what are the opportunities of implementing DFAs in the financial sector.

-

Blog

4 Overlooked Key Benefits of Agency Banking

Here are some unconventional ways to look at the benefits of agent banking and why financial institutions should consider to adopt the agency channel.

-

Blog

Legacy Financial Institutions Also Want to Leverage Technology for Sustainability

Kaiser Naseem, international development banker and digital transformation expert, shares his thoughts on the growing digital finance space.