Helping Banks Lead in the Digital Era

Fast time to market with digital initiatives

Quickly launch new digital products and services. Start fast with what you need and scale as you grow. Adopt new technologies with ease.

Omni-channel customer centricity

Rethink the ways customers interact with you across channels. Become your customer's "everyday bank", exceeding expectations.

Open banking realized

Monetize the open banking opportunity. Integrate with your value-chain partners to create customer value and unlock new revenue streams.

Platform-driven digital transformation

Innovate without replacing costly systems and easily scale beyond your core. Streamline processes to boost operational efficiency.

Compliance excellence in a digital world

Integrate any regulation or risk requirement end-to-end across process workflows (PSD2, GDPR, AML, FATCA, etc.)

Rapid innovation

Win in the digital race with a modular and scalable digital banking platform, supporting your digital growth ambitions.

End-to-end Digital Banking Solutions

Built on a single, mature and future-proof platform, enabling quick time to market,

easy scaling, and cross-channel workflows.

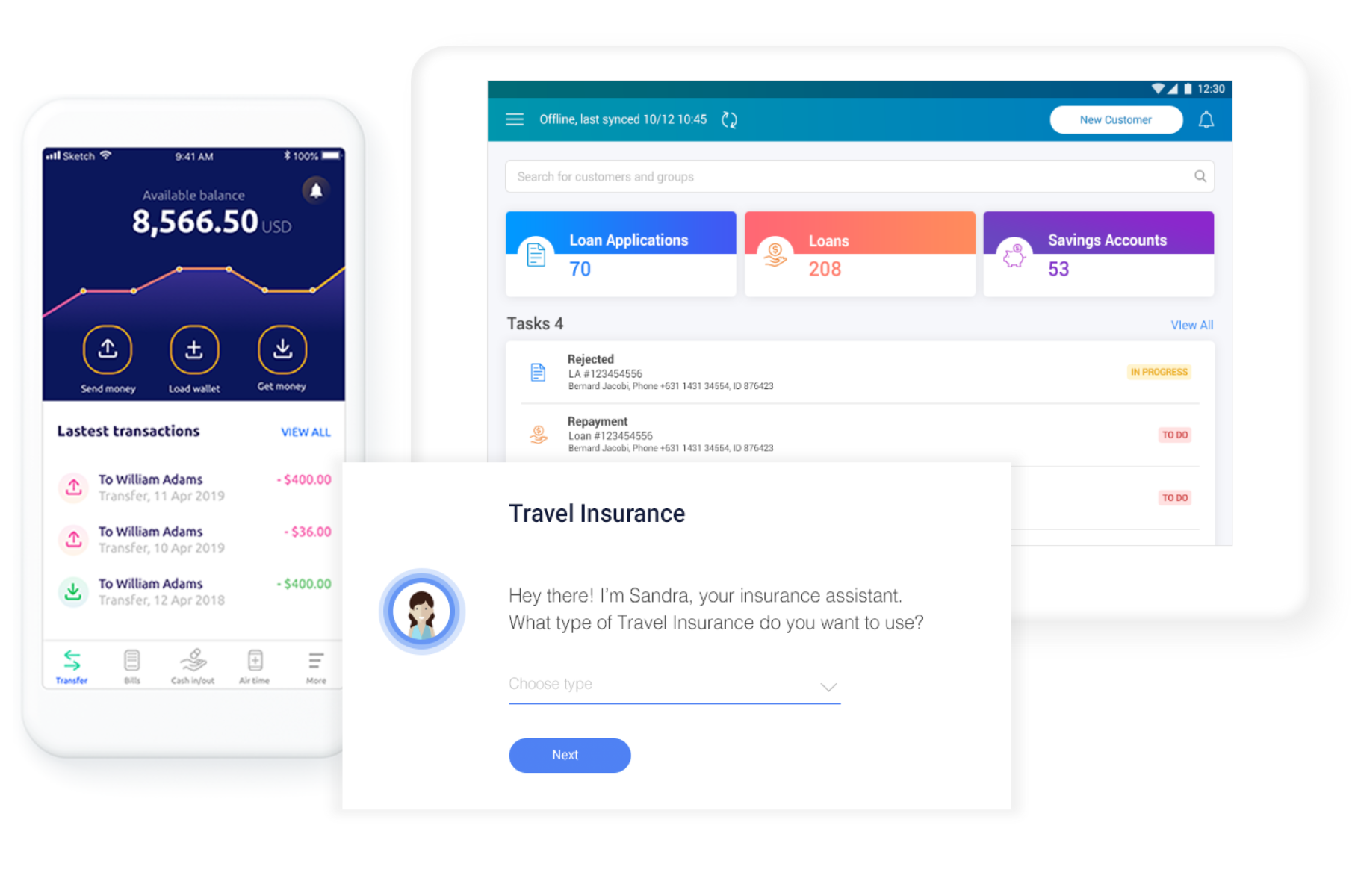

Mobile Wallet Solution

Your complete mobile money and mobile payments solution.

Learn more

Onboarding & Origination

Seamless onboarding and origination with secure authentication and identity management.

Learn more

Digital Bank & Neobank

Your unrivaled digital bank proposition, backed by an end-to-end digital banking platform.

Learn more

Enterprise Integration Platform

Build and orchestrate a connected business.

Learn more

Payment Switch and Card Management

An easy and affordable start with Cards, ATM and POS networks.

Learn more

Internet and Mobile Banking

Exceptional self-service banking on any device that meets customer expectations.

Learn more

Mobile Factoring Solution

A groundbreaking mobile factoring solution that brings together all the parties in a bank's factoring business.

Learn more

Tailored digital banking solutions

Based on over 10 years of global experience. Built on our mature DigiWave digital banking platform.

Contact us

Powered by DigiWave Digital Banking Platform

Led by microservices and APIs, DigiWave comes with configurable digital banking capabilities, such as onboarding & origination, multi-factor authentication, identity management, forms, workflows, payments, integrations, chatbots and more. Deployable on premise or in the cloud. Easy to integrate with any core banking system.

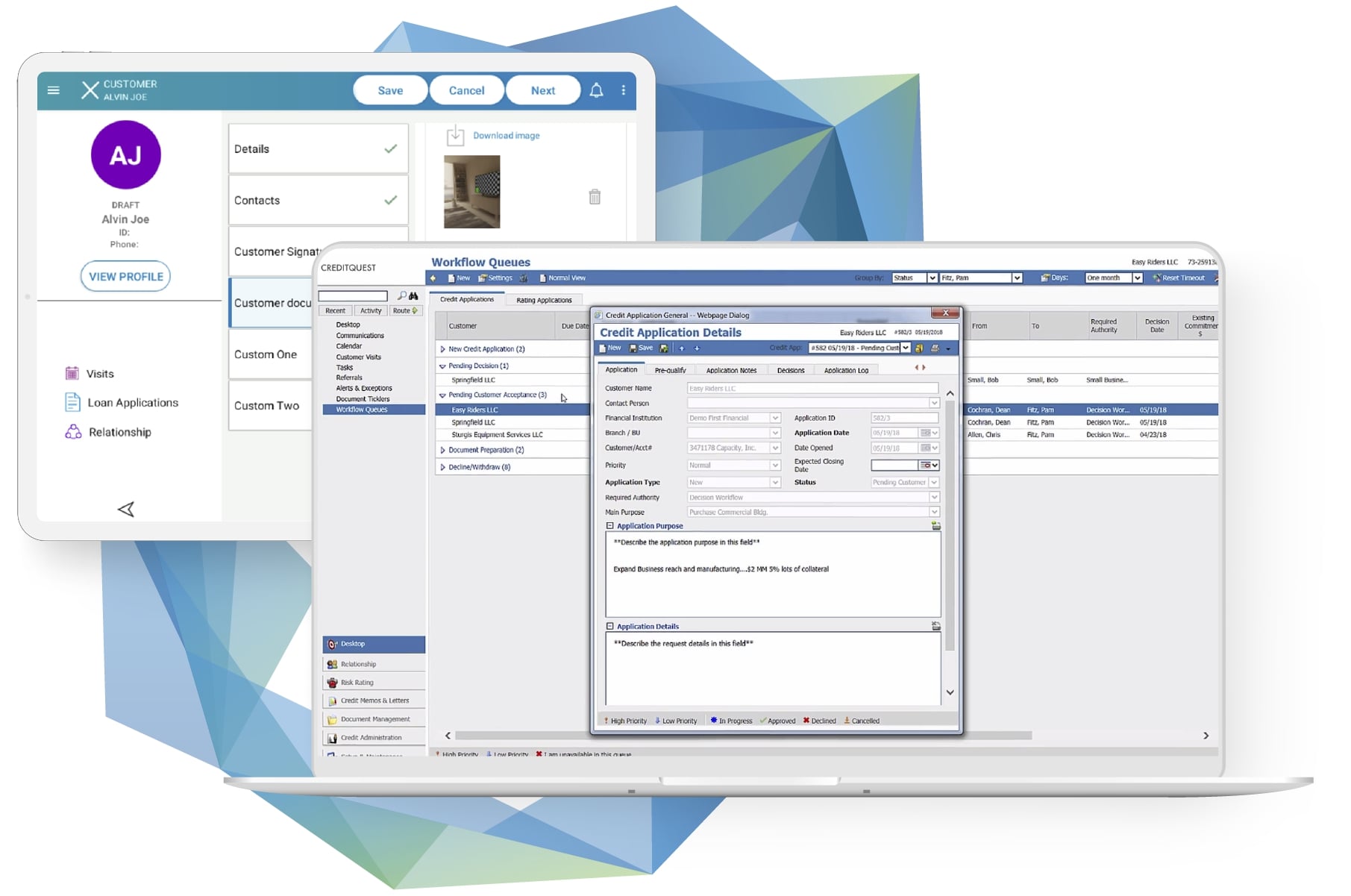

In Focus: CreditQuest Loan Origination Solution

Streamline the credit process, manage credit and operational risk and grow a profitable loan portfolio.

Trusted by leading organizations across the globe, CreditQuest delivers real results for bank teams from application to disbursement.

A single solution for commercial and retail loan origination, risk ratings, advanced analysis, underwriting, documentation, executive reporting, and portfolio management with a focus on the customer relationship.

Inclusive Finance Solutions

Extend your offering to underserved or unbanked segments through cost-efficient branchless banking channels. Mobilize deposits and deliver convenient services in previously untapped markets.

Agency Banking

Expand your market at a low cost via an agent network.

Learn more

Digital Field Application

Deliver differentiated, cost-efficient doorstep banking services.

Learn more

USSD-enabled Mobile Wallet

Provide convenient, low-cost banking and value-added services to mobile customers.

Learn more

Tailored inclusive finance solutions

Unlock remote markets through profitable and cost-efficient alternative delivery channels.

Contact us

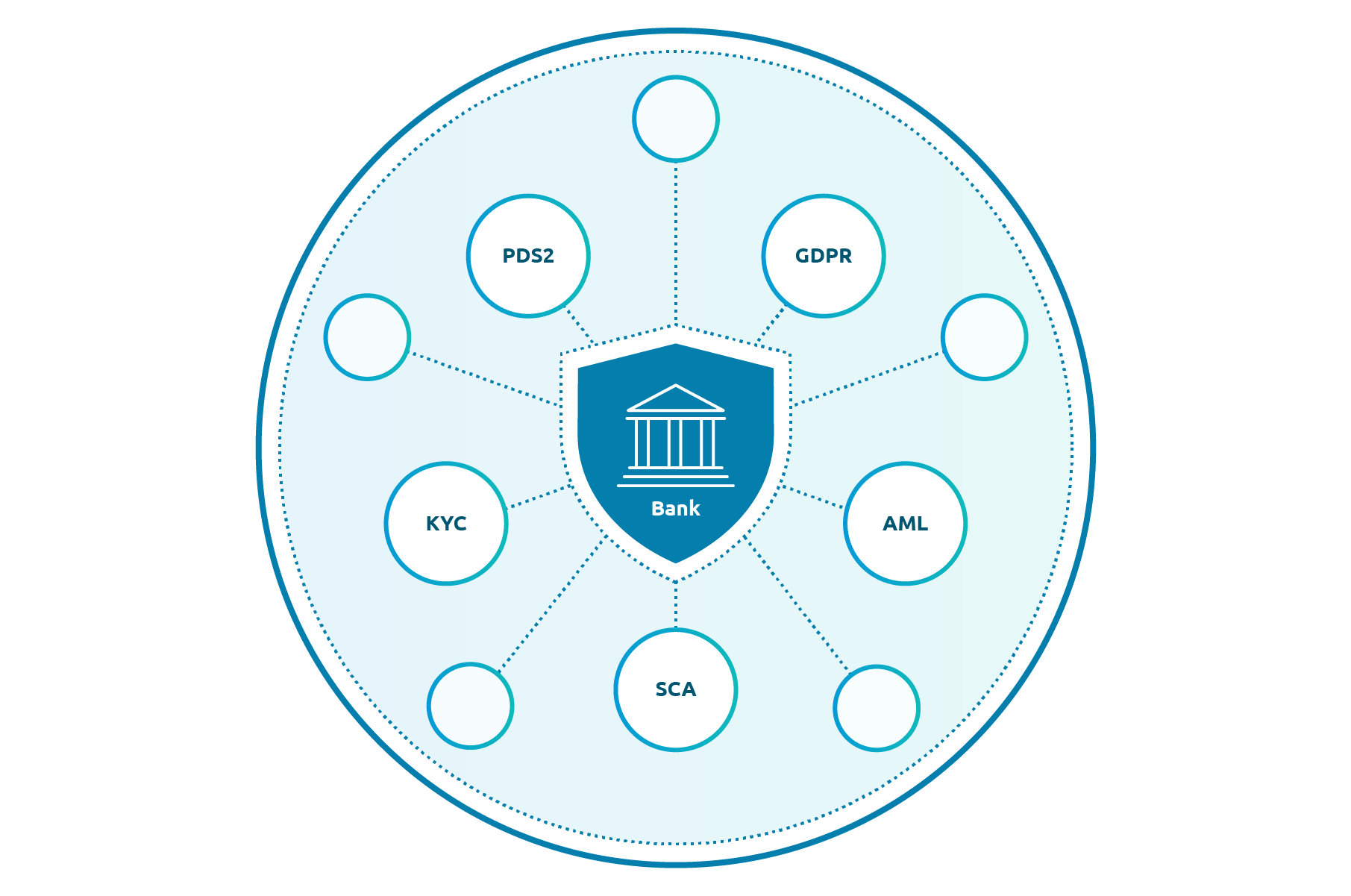

Achieve Compliance Excellence in a Digital-first World

Software Group's solutions help banks digitally transform with a future-proof approach to compliance.

- Centralize customer data across systems, facilitating data governance in accordance with regulations (such as the GDPR).

- Integrate with third parties to ensure compliance in areas, such as AML, embargo sanction lists, FATCA compliance, etc.

- Meet Know Your Customer (KYC) requirements through secure Authentication & Identity Management

- Flexibly integrate any regulation and risk requirement starting from onboarding and origination through to servicing processes through DigiWave's strong Workflow, Task and Document Management

- Comply with PSD2 with Strong Customer Authentication (SCA) and Consent Management

- Control 3rd-party relationships with advanced API capabilities, and more.

-

Analyst report

DigiWave Platform Recognized in 2023 Independent Research Firm’s Overview

Software Group acknowledged among the notable vendors in the Forrester report “The Digital Banking Engagement Platforms Landscape, Q1 2023”.

-

Blog

Top 10 Banking and FinTech Trends to Watch in 2023

What are the key trends that will shape banking and fintech in 2023? The opportunities and challenges of AI, payments, ESG, Super Apps, and more.

-

Blog

How to Choose the Best Digital Banking Platform?

In this blog, we focus on the key capabilities of digital banking platforms as a critical advantage for success in the digital era.