The Platform on Which You Can Build Your Digital Future

Not simply a portal or an app, but an end-to-end, modular digital insurance platform which enables insurers to be agile, fast, and customer-centric, digitizing the full insurance lifecycle across channels, systems and operations with a future-proof approach.

Bring immediate value through digital portals and mobile apps with superior experiences for customers, agents, and brokers.

- Customer Self-service Portal

- Customer Mobile App

- Agent/Broker Sales Portal

- Standard Modules: Travel, Motor, Property, Health (Personal and Corporate)

Modernize legacy systems and digitize operations end-to-end to reduce costs & risk, and improve efficiency.

- Full insurance lifecycle digitalization & automation

- Powerful integrations to core and external systems

Innovate and scale at speed with tailored solutions that give you a competitive edge in the new digital ecosystems.

- Custom solutions

- Easy adoption of new technologies and models - IoT, AI, analytics, connected & embedded insurance, etc.

Helping Insurers Achieve Their Strategic Priorities

2ac9.png)

Premium Growth

Through both traditional distribution and automated digital self-service channels

Faster Claims at a Lower Cost

With process automation, and delightful digital claims submission & transparent status tracking

Satisfied, Loyal Customers

Thanks to clear and transparent information for customers, and best-in-class CX across the full policy lifecycle

Lower IT Costs & Easier Compliance

Saving Capex & Opex in core system upgrades and facilitating compliance

Rapid Innovation

5+ times faster digital innovation and new revenue opportunities with data, APIs & ecosystems

Digitize The Customer Lifecycle End To End

Deliver the integrated customer-centric insurance experience that keeps customers coming back

Customers are quick to notice disconnected experiences. Integrate the full, end-to-end customer lifecycle - from discovery, through policy purchase, payments, claims and renewals. Reinforce the value of your brand to retain and grow the customer relationship and maximize lifetime value in the digital era.

6913.png)

Customer Self-service Portal & Mobile App

Everything your customers need, in one place, in real-time across channels

Interactive Quoting & Policy Sales

Digitize the sale of any type of insurance you’re offering. Guide customers with an interactive quoting tool and automated, online policy purchase. Free up staff time and reduce service costs.

Digital Customer ID

Let customers self-register and control their personal details at all times with a secure Digital Customer ID. Provide easy and secure access.

Digital Payments

Enable consumers to pay for insurance on the fly at any time for themselves or for others, in their preferred way: by card, mWallet, in a number of instalments, etc.

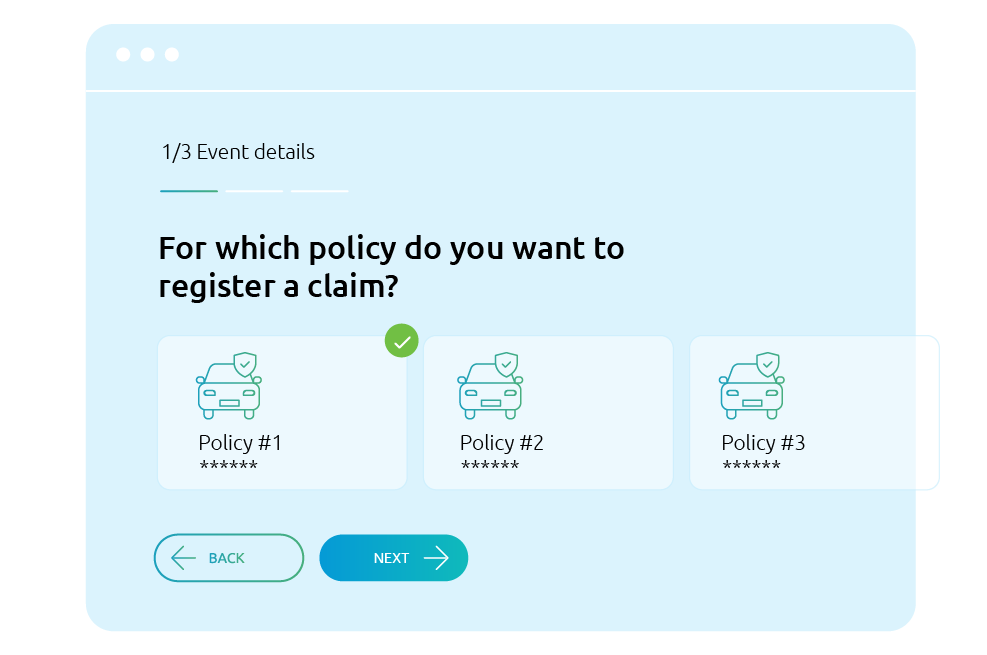

Digital Claims

Win consumer trust and satisfaction with a quick and easy claims submission process (FNOL) with documents and image upload & full claim status visibility. Speed up claims processing and reduce fraud.

360-degree Policy Management

Delight customers with a one-stop place for all their policies issued from any channel - digital, agent, branch. Let them manage, pay, renew policies, follow up claims, and get new offers for cross-sell/ up-sell.

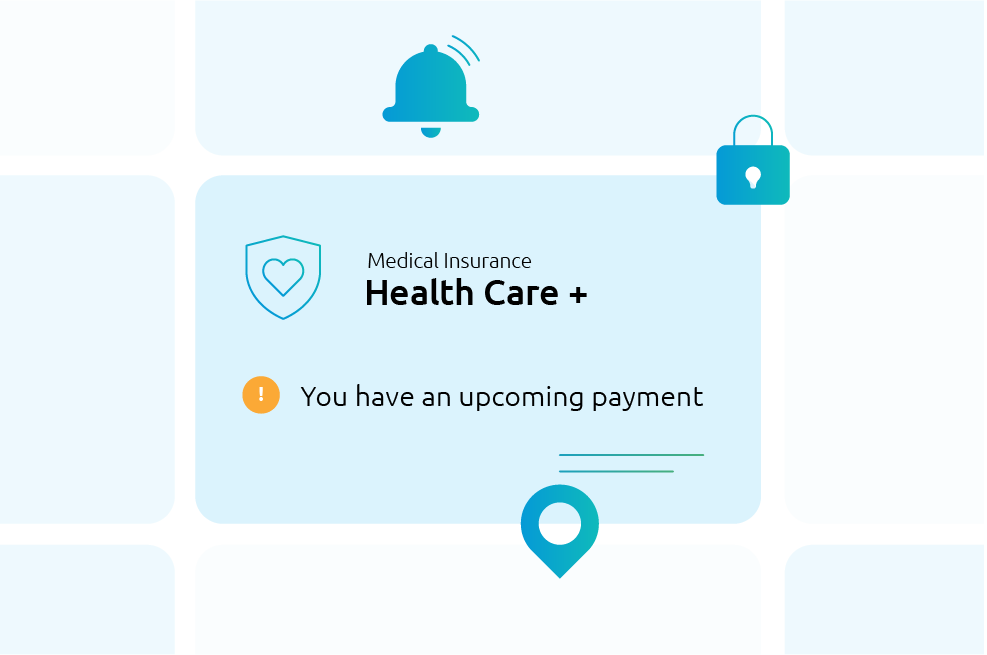

Dashboard, Alerts and Notifications

Keep customers informed at all times & increase premium collection rate. Help them not miss important events like upcoming payments, documents pending for claims processing, claims status updates, etc.

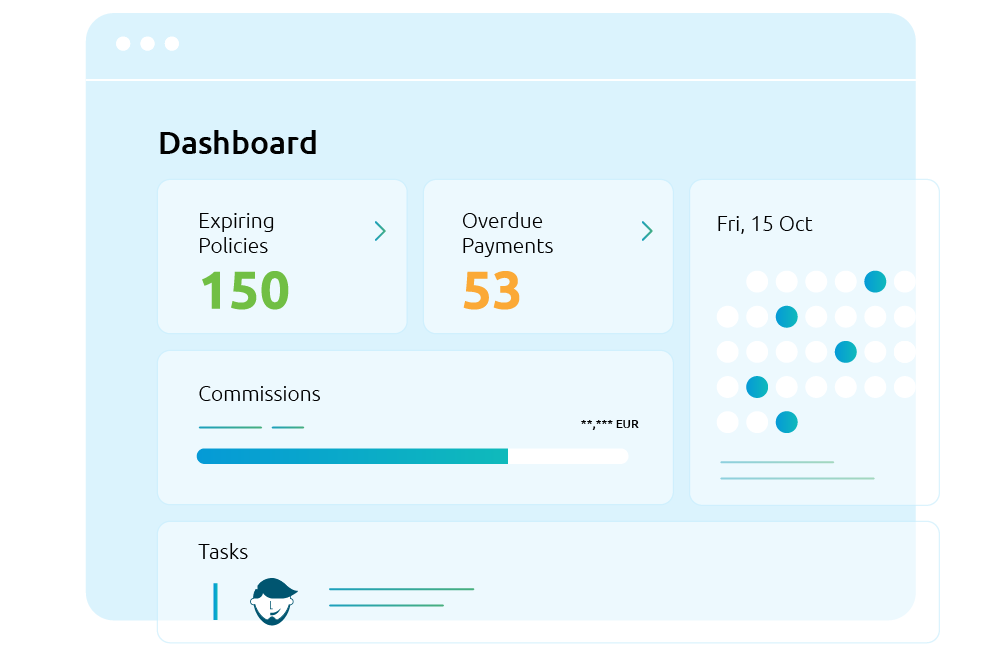

Agent/Broker Sales Portal

Elevate agents through digital. Remove complexity for your distribution partners and enable them to provide excellent service.

Offload agents from administrative tasks, allowing them to focus on high-value sales. Increase the productivity and sales volumes of traditional channels:

- Home Dashboard for all the latest updates and key information about an agent’s work

- Quote and Bind tool for agents for policy sales and renewals for multiple lines of business

- Customer 360 approach - provides a single place for customer’s portfolio and history, a much faster, holistic way to understand the customer

- Easy policy administration - changes, documents, and payments

- Sales reports, intuitive dashboards and clear performance KPI's for agents

The Digital Insurance Platform at a Glance

Bring your insurance business into the digital future with a proven, omni-channel digital insurance platform.

Become Truly Digital without Changing Legacy Systems

Get the digital advantage now and keep pace with change with a future-proof digital platform

DigiWave is a user-friendly, smart layer on top of core insurance systems that speaks to them seamlessly behind the scenes. Get the digital advantage now, while saving Capex & Opex in core system upgrades. Facilitate compliance with insurance regulations, such as GDPR, IFRS17, etc. Become agile and customer-centric, while saving costs, increasing speed, reducing risk, and improving efficiency by more than 30%.

c541.png)

Step into the Ecosystem Future with Confidence

Ready to venture into new business models? Set yourself up for growth through APIs, data & ecosystems.

5f67.png)

The insurance value chain is being transformed by new connected digital ecosystems. Build relationships with ecosystem partners in hospitality, mobility, travel, retail, banking, health to embed offerings for consumers in the right context.

Leverage connected insurance to shift your focus to risk prevention and implement new ways of pricing and underwriting. DigiWave makes it easy to connect to anyone and adopt innovative technologies like IoT, AI, virtual assistants, RPA, analytics, etc.

Driving the Future of Digital for Leading Insurance Providers

Enterprise-level digital insurance platform with global credibility

Digital Insurance Channels Platform for One of the Top 3 Insurers in Europe

Bancassurance Platform as Part of Full Digital Transformation Project for Allianz Bank

Managed-Health Platform for the 2nd Largest Banking Group in West Africa

What Differentiates Software Group

End-to-end digitalization partner for your future-proof digital path

Supporting you every step of your digital journey with a mature platform and cutting-edge digital know-how.

Fast time to market

Achieve high positive ROI from digital within months. Cloud, on-premise or hybrid deployment.

Rich experience and insurance sector expertise

Over 12 years of global financial sector experience with 200+ customers and 500+ projects in over 70 countries.

One vendor, one platform

One-stop-shop experience with ready capabilities. Completely customizable to your business case.

Exceptional, omni-channel CX

Best-in-class UX design expertise to attract and retain customers with superior digital experiences.

Ecosystem readiness and powerful integrations

Strong integration experience, powered by API-led, modular, microservice platform architecture.