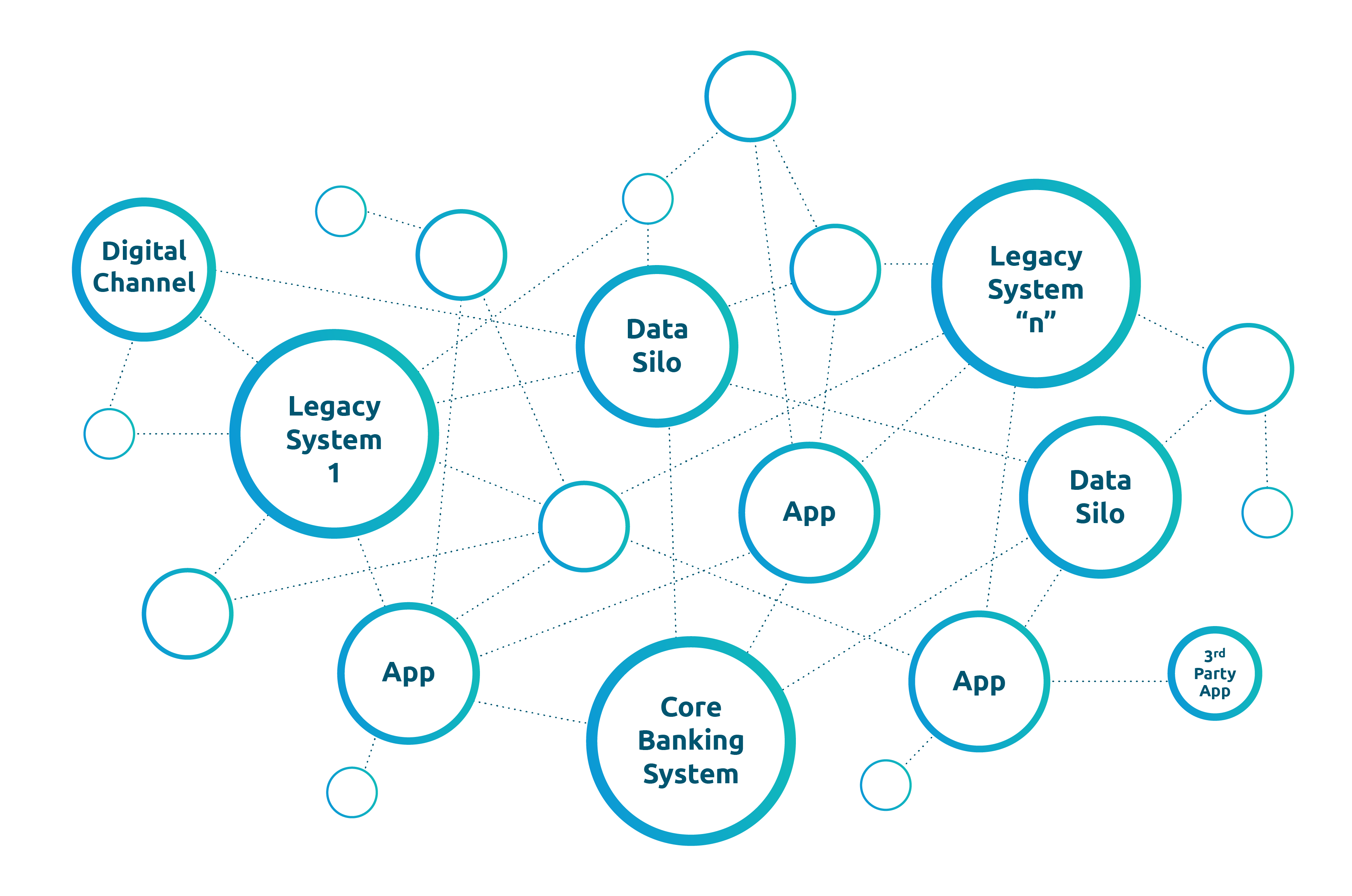

Integration Challenges - How Did They Arise?

Why are They a Barrier to Business Growth?

Higher Costs

The lack of centralized integrations directly impacts your bottom line, causing higher IT maintenance costs, increased operational risk and high compliance costs.

Poor IT Efficiency

Without an integration platform, it is difficult to service and monitor systems centrally. IT assets are poorly reused, data integrity suffers and scaling is hard.

Poor Customer Experience

Siloed systems create a higher risk of IT incidents and system overload, which directly impacts experience. Personalization without unified data is also difficult.

Competitive Disadvantage

The lack of proper integrations makes it difficult to implement new technologies and partnerships. Going to market with new digital initiatives is slow and complex.

The Solution: Enterprise Integration Platform (EIP)

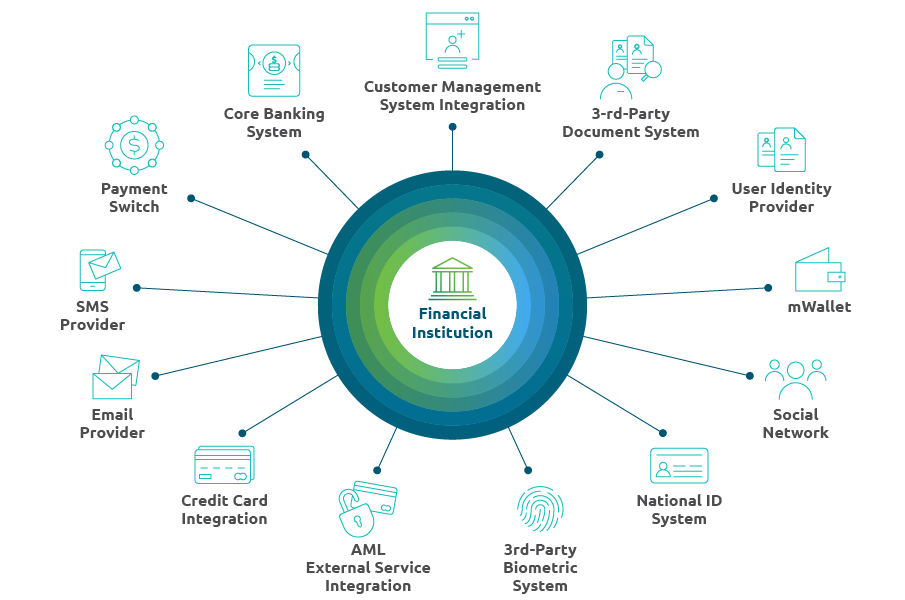

Build and orchestrate a connected digital business

An integration solution, specially designed for the needs of the financial sector. EIP modernizes legacy infrastructure via APIs, advanced integration patterns and reusable microservices, transforming everything into a future-proof digital platform, driving success in the open banking era. GDPR and PSD2-compliant.

7d01.png)

EIP Helps Financial Service Providers to:

The Benefits of Enterprise Integration Platform

Modernize Legacy Systems

Connect your business end-to-end to increase its scalability. Focus on what really matters - growth.

- Central monitoring: Control your whole IT landscape from a centralized space.

- Efficiency: Enable business continuity, when a system fails or is inaccessible.

- Vendor independence: Replace any system by simply connecting the new one to EIP.

- IT asset reusability: Easily share resources across systems and channels.

Facilitate Innovations and Partnerships

Be ready to compete. Innovations and partnerships are one integration away with EIP.

- New technology adoption: Invest in innovation rather than in maintenance projects.

- Partner integration: Partner with your ecosystem to offer aggregated services to customers.

- Fast go-to-market: Launch new digital initiatives with ease.

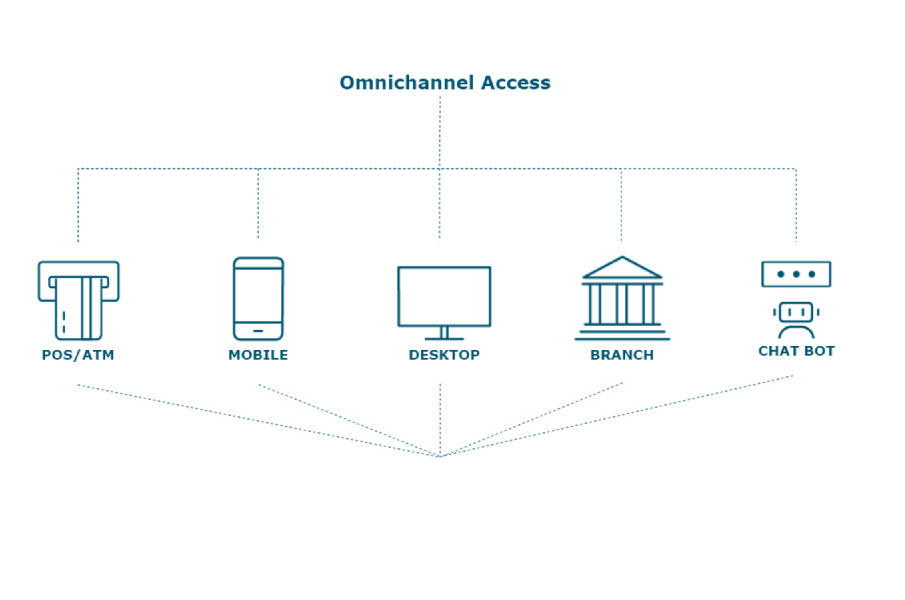

Enable Omni-channel Customer Experiences

Move from account-centric to a customer-centric future with EIP.

- Channel integration: Deliver seamless customer journeys across connected channels.

- Data integration: Unify customer data to enable 360-degree views of customer relationships.

- Customer insights: Connect analytics, BI and AI tools to understand your customers better.

- Customer engagement: Integrate services beyond the traditional to become your customer’s closest digital partner.

EIP is Ready for Open Banking. Are You?

Open banking is urging traditional financial service providers to fundamentally rethink their business model.

It is a collaborative service model, based on open APIs, where data is shared among ecosystem players, including non-financial 3rd parties (such as retailers, real estate companies, etc.).

In an open banking world, plug-and-play financial products are enabled, and customers have the final word, choosing the superior experience.

Succeed in Your Open Banking Journey with EIP

Enterprise Integration Platform - Technical Overview

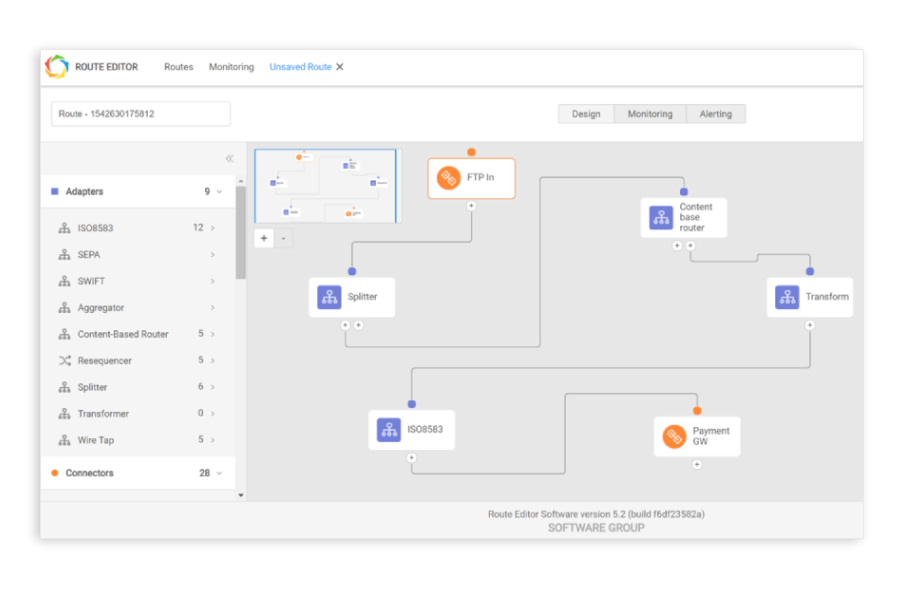

INTEGRATION FRAMEWORK

- Flexible, Easy-to-use SDK

- A Rich Set of Enterprise Integration Patterns

- Microservice Architecture, powered by Docker, Kubernetes, Cloud-ready

- Inbuilt Message Encryption

- Monitoring, Auditing, Logging

- Notifications and Events

API GATEWAY

- Load Balancing

- API Security and Policies:

- Circuit Breaking

- API Segregation

- Quotas & Rate Limiting

- API Monitoring