New Zealand's first local mobile wallet Dosh

How did Dosh come about?

In late 2020, after several years living and working in Singapore, Kiwis Shane Marsh and James McEniery returned to New Zealand due to the Covid pandemic. Aside from the people, culture, and cuisine, it was the ease and convenience of mobile wallet applications the pair would miss the most from their time in Asia. This posed the question "Are there mobile wallets with such capabilities and flexibility in New Zealand?" The answer was ‘’No’’.

The founders of Dosh discovered that the financial services market in New Zealand was not on par with financial technology innovation in other countries. Traditional banking is limited to Monday to Friday and businesses cannot pay staff or other businesses after hours or at weekends. Traditional bank providers require customers to share a personal 16-digit bank account code to make a transaction. Consumers expecting payment via bank transfer must regularly check their account instead of being instantly notified of money moving. Funding opportunities are limited for high value transactions, and fees paid by businesses to receive payments are among the highest in the developed world.

Motivated by these shortcomings, Shane and James created Dosh, New Zealand’s first mobile wallet, with the idea of serving both business and individuals, making transactions fast and affordable.

How does Dosh work

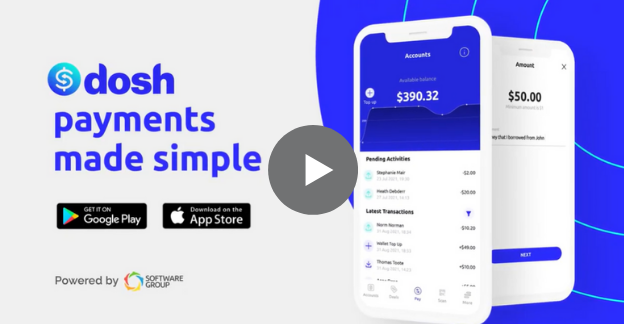

The Dosh app comes in two versions: Dosh for Consumers and Dosh for Business.

The consumer version enables instant payments between friends using just their mobile phone number. Money moves instantly, meaning users no longer need to wait until Monday for funds to clear. Dosh users can instantly request payments, split out costs and pay people back at the touch of a button. The app can be downloaded for free from the Apple or Google app stores.

The business version enables merchants to receive contactless payments anytime, anywhere via a generated QR code. They can also create tailored ‘Dosh Deals’ to promote to users in their region. Business customers must register at dosh.nz then set up their business profile to start selling and receiving payments via Dosh.

Record Seed Round Funding Raise

In March 2022, Dosh announced it had raised seed funding of $5M in what is believed to be a New Zealand record for a seed investment round. The funds came from existing Dosh investors and will enable the company to vastly accelerate growth and technical capacity in 2022. The investor interest reflects trends offshore where fintech has dominated new Venture Capital investment. According to research firm CB Insights, one in five VC investment dollars in 2021 went to fintech. CB Insights estimates digital wallet fintech sector to be a $1tn global industry today and is forecast to grow to $7tn by 2027.

Dosh co-founder Shane Marsh says, “The significant Dosh raise reflects the material opportunity in New Zealand for a locally grown, digitally focused competitor in the banking services market. We believe there is a gap in the market for Dosh to provide services that give Kiwis greater freedom and control over their money.”

Global Partnership Announcement Imminent

Plans this year include a soon-to-be-announced global partnership which will change the game entirely for Dosh customers. Dosh has ambitions to become the one-stop financial super app for all Kiwis, with plans to integrate further capabilities.

Says Shane Marsh, “At Dosh we are proud to be leading this change with our launch of New Zealand’s first mobile wallet in 2021. Payments is just the beginning for Dosh; we have a big year of new developments planned and are excited to take Kiwis on the journey with us.”