How do you imagine a successful mobile wallet?

You might visualize it as a digital payment app that combines state-of-the-art technology, security, speed, convenience, and intelligent features that make cashless payments easy for everyone.

However, success comes to those who manage to achieve significant adoption of their wallet, and often the tactics involve more than cutting-edge software.

Some of the most popular mobile wallets and challenger banks (like Apple Pay and Revolut) prove this. They win customer love by offering more value - engaging experiences, exciting surprises, loyalty points, rewards while shopping, etc.

To inspire brand loyalty and make customers choose you over competitors, you need to go above and beyond a payments app.

This is where mobile wallet marketing strategy enters the scene.

What is mobile wallet marketing?

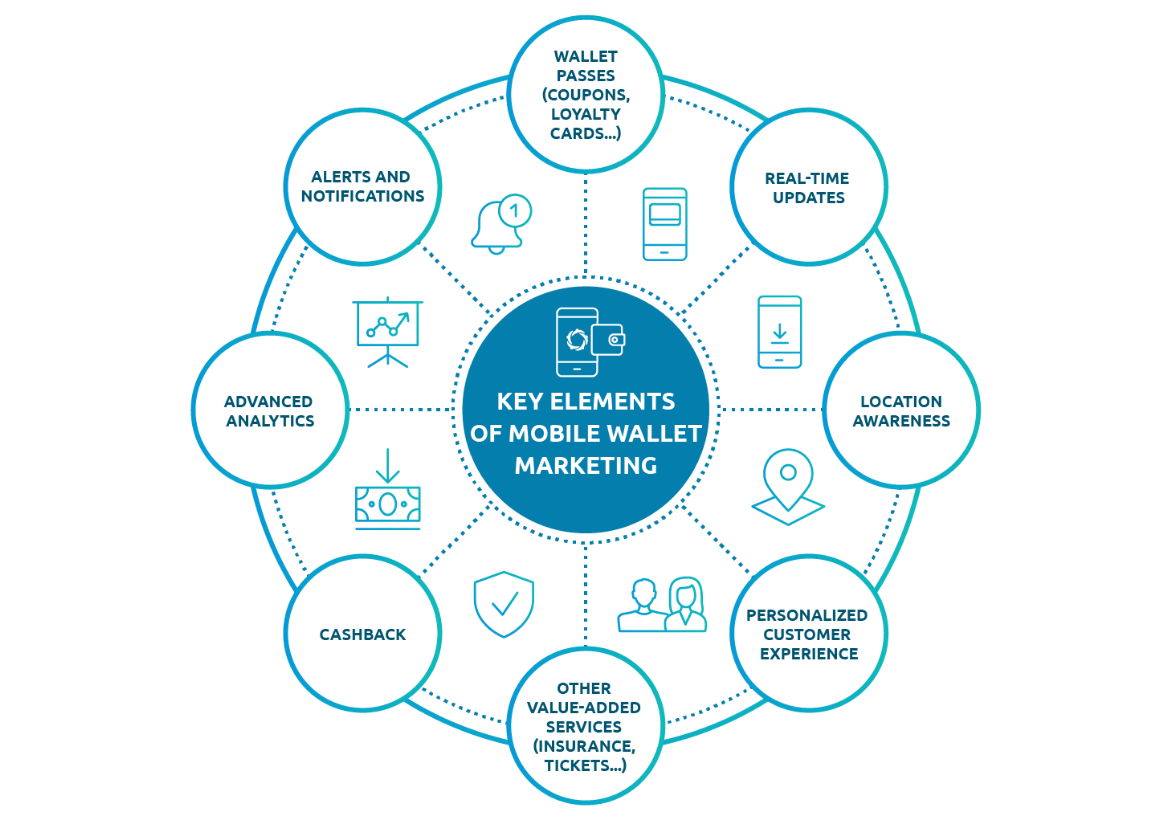

It encompasses all marketing efforts and tools (such as loyalty cards, coupons, value-added services) that engage, grow, and retain the customers of a mobile wallet app.

Note that to leverage the advantages of mobile wallet marketing, e-wallet operators need to make sure that their digital wallet platform offers or allows for the easy integration of 3rd-party services and marketing tools via APIs.

The Power of Mobile Wallet Marketing

Today, at times of economic challenge, the adoption of certain digital payment solutions may well be dependent on heightened customer preferences for discounts and special offers.

And digital wallets can be a perfect solution for smarter shoppers seeking deals and promotions.

As per Walker-Sands research, 63% of consumers say they will change their purchasing habits in order to maximize loyalty benefits.

Airship's survey of US and UK consumers found that 54% of the respondents have already used a mobile wallet card – and wish brands would more often use loyalty cards, coupons, etc.

Wallets provide a beneficial channel for both financial institutions and their merchant networks to turn wallet holders into loyal customers who keep coming back to transact via the wallet.

Furthermore, loyal customers tend to refer brands to their friends or colleagues, which helps drive new clients through word-of-mouth.

Key Elements of a Successful Mobile Wallet Marketing Strategy

1. Wallet Passes

Before diving deeper into mobile wallet marketing, we need to explain what a mobile wallet pass is, as the pass is one of the key tools with regards to retail and e-commerce marketing via a wallet.

A mobile wallet pass is any non-payment item (such as a loyalty card or a coupon) stored in a mobile wallet.

Adding a pass to a wallet should be as easy as 1-2 taps. The wallet enables customers to keep all their passes in one convenient central space.

• Coupons & Vouchers

This functionality allows financial service providers and their merchant networks to create customized coupons & vouchers (with company logos or colors) and instantly send them to a customer's phone.

Vouchers are normally issued for one-time transactions for specific goods and services (discounts or full product-value), while coupons in general could be redeemed for more than one purposes.

After customers add a coupon to their device, the operator can update the offer, provide new images or send notifications with expiration reminders.

Voucher and coupon redemption can be tracked to learn more about customer behavior. Customers can also be targeted by location with geo-triggers and notifications.

There are many ways to personalize coupons and vouchers in mobile wallets and make them an effective lead magnet.

For example, merchants can offer a discount to a specific segment of people based on their previous purchasing behavior, age, occupation, and more.

Many customers are price-sensitive. Simple and strategic mobile wallet vouchers and coupons, relevant to the shopper's needs are next-gen marketing tactics to increase customer retention.

• Loyalty Cards

Like coupons, loyalty cards also can be updated in real-time, they can send location-based messages and let the wallet operator and its network of partners target specific customer segments.

But as a different wallet pass type, they have some unique features that drive customer engagement.

For instance, customers could be notified when they reach a higher level of loyalty program and are changing their status (e.g. from “Silver” to “Gold”).

Furthermore, merchants could reward wallet users for reaching the new level (e.g. with a free drink) or provide an extra gift to the most loyal, such as a VIP membership.

When wallet users enter a store, merchants could send them a welcome message on their phone together with a reminder to collect their loyalty points. This can be a fantastic call-to-action tool, right on the spot.

Loyalty cards though should provide effortless validation methods. The retailer should simply scan the QR code/ barcode on the customer's phone when shopping in-store.

A smart and comprehensive loyalty program that keeps customers engaged with fresh, exciting reward ideas, can help both financial and non-financial businesses stand out.

• Other Mobile Wallet Pass Types

Loyalty cards and coupons are just two examples of direct contact with customers through mobile wallet marketing.

Membership cards can hold points which could be updated inside the wallet, also allowing the operator to instantly send important information to their members.

Some other examples of passes include gift cards, business cards, booking confirmations, boarding passes, loyalty cards with cross-promotions, sweepstakes, exclusive offers, stamp cards, and more.

• Real-time Pass Updates

Mobile wallet passes can be seamlessly updated with new information at any time, including their design - no need to delete, add or download a new pass.

For example, merchants can update their promotions with a “last chance” alert before a deal expires or provide a surprise offer to differentiate with a superior customer experience.

The majority of customers keep any received wallet passes and almost never delete them, which gives marketers a new chance to re-engage users with new offers.

2. Cashback

Instant cashback is another incentive urging customers to transact more with their wallet. Mobile wallet cashback rewards are easy to redeem, fun to use, and straightforward to value.

The functionality not only saves money for customers, but also enables them to directly use the cashback to make purchases with the mobile wallet, send money to friends P2P, or transfer it to their bank account, for example.

Cashback is all about allowing customers to get the most out of their money. So, it is advisable that it is offered as a frictionless experience - without tough redemptions or other difficulties for users.

3. Notifications

The true mechanics of mobile wallet marketing lies in notifications.

Various alerts and notification types (email, SMS, MMS, lock screen notifications) can be used by digital wallet operators and their partners to let users know about a new offering.

Lock screen notifications have proven to be one of the most powerful ways to draw smartphone users’ attention, driving significantly higher response rates.

Notification content can be personalized for targeted marketing campaigns to the right people at the right time.

To maximize notification effectiveness, you may schedule them for terms like time, date, frequency, or conditions, such as purchase history and collected points.

4. Location Awareness

Once a wallet pass is installed, a strategic location can be specified with it by adding coordinates or integrating with a solution that provides location-based information like iBeacons.

When a customer enters a location, the wallet can automatically send a screen-lock notification to the customer’s phone with an engaging proposition. A screen tap takes the user directly to the wallet pass.

For example, a customer is walking by her favorite cosmetics retailer, when she gets a notification for a limited-time-offer of a 35% discount on any item in the store.

Location-based notifications perfectly combine 4 major elements of success: the right location, time, relevance, and value - a win-win combination for both customers and merchants.

5. More Value-added Services

With the multitude of apps available nowadays, more and more customers prefer the aggregation of key services into one app for convenience.

This is especially evident in banking, where the boundaries between digital wallets and mobile banking apps are starting to blur.

Embedding value-added services into a financial wallet can be a good strategy for retaining customers and driving more wallet usage.

For example, a bank could differentiate its wallet by adding value from its ecosystem - insurance offerings, bill payments, remittances, and even non-financial services like subscription management.

6. Advanced Analytics

Mobile wallets can act as an excellent platform for data collection of customer insights. Data can then be used to feed improvements in the mobile wallet marketing strategy.

For example, mobile wallet pass performance could be tracked and analyzed through easy-to-use dashboards.

Rich data analytics insights can be extracted from transaction histories, repeated purchases, deletion percentages, coupon redemption, check-ins, the ROI of mobile loyalty programs, etc.

Mobile wallet data could be leveraged to create highly personalized interactions for consumers, pushing the relevant mobile offers and driving loyalty.

How Can Software Group's Mobile Wallet Help You Drive Customer Loyalty?

We believe that a digital wallet app should extend beyond digital payments to create long-lasting relationships between financial service providers, their ecosystem partners, merchants, and consumers.

With more than a decade of experience driving digital transformation for financial organizations worldwide, we can help you build a unique mobile wallet solution that wins people's love, drives adoption, and inspires loyalty in millions.